Important note

This article has nothing to do with programming (main theme of the website), however it is very useful for those who receive earnings online via PayPal, so for this reason it was decided to publish this article on the main blog in Spanish.

It should be noted that we do not have an alliance with Bancolombia or anything like that, as a Colombian, I only highlight how great and super useful this new feature is in the Nequi application.

As a web developer, part of your online earnings are paid through PayPal. Unfortunately in a country like Colombia, until 2018 the only way to withdraw that money was by having a business account with the Davivienda bank (you must have a company, etc. which does not serve natural persons in any way). Many other people were looking for an alternative solution to this, such as having a contact abroad where they can consign the balance of the PayPal account to the bank, send them the money and have them send it back to you through a means where it is possible to obtain money in Colombia, such as Western Union or other types of services.

Fortunately, thanks to the Colombian spirit of innovation, the banking entity Bancolombia published one of the most promoted mobile products with Internet advertising called Nequi, a tool that will help those of us who earn money online and who receive payment in PayPal, to send it to our bank account in Colombia through the digital savings account that this application offers us.

What is Nequi

Nequi is an app to manage and use money very easy and from the cell. To use Nequi we offer you a simplified savings account, which you open in 5 minutes with just your phone and without having to go to the office. With Nequi you can save and organize your money, pay online and on dataphones, withdraw money at Bancolombia ATMs and send free money throughout the country. It does not matter if you have never had a bank account, you can also save your money in Nequi's savings account.

The most important thing for us in this article is that you can send your PayPal balance to Nequi and from there you can consign it to a bank account in Colombia.

1. Download the Nequi mobile application

The application is available for cell phones from the Play Store (for Android-based mobiles) or the App Store (for iOS-based mobiles). For more information, visit the official Nequi website .

2. Register, send your photo, identity card and personal data

Note

Being a banking entity like Bancolombia, you can feel safe when sending this information through the application.

To create a savings account in Nequi for free, you simply have to register as in any service with your cell phone number, your identity document p. ex. citizenship card. You will be asked for a photo of this document, a photo of yourself that you can take during registration with the cell phone camera, you will be asked for your address and profession (in my case select student).

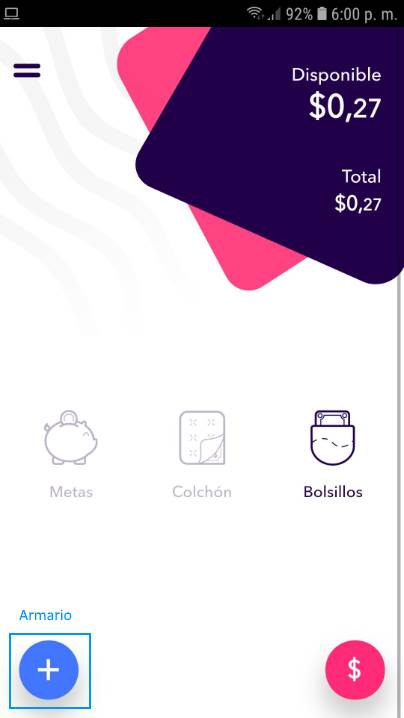

In this step I did not take more than 5 minutes and everything is done through the cell phone. After completing the registration, you will be able to access the application:

and follow the next step (we have some balance because the screenshot was made some time after testing the application).

3. Send money from PayPal to Nequi

The logic that the application follows is to receive dollars and convert them to Colombian pesos, basically they buy your dollars to make it easily understandable. Sending money to a bank outside of Bancolombia from your Nequi account takes up to one business day and costs $ 7,500 COP. If the intended account is a Nequi account or a Bancolombia checking / savings account, the shipment is totally free!

To send money from your PayPal account you must link it through the application. Open the application locker and select PayPal from your options:

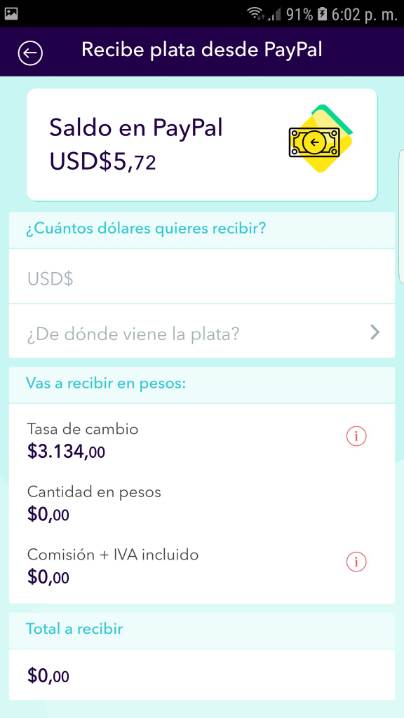

If you have not yet linked the account, you must follow the process that asks for the email with which you have associated your PayPal account, then they will redirect you to PayPal to confirm the connection between PayPal and Nequi. Once the process is finished, Nequi will be able to obtain information about your account, such as the balance, which it will mention to you when withdrawing the money. When you enter the PayPal area again, you will see your balance and a form that asks you how much you want to spend to your nequi account etc .:

Nequi imposes a limit on receiving money, you can receive up to $ 700 USD (seven hundred dollars) each month, the exchange rate may vary due to market behavior and each shipment costs you 5% of the amount you are going to receive, however you will never pay more of USD $ 10.

Real example (made by me)

For example, today $ 100 USD (one hundred dollars) was sent from my PayPal account to my nequi account, to which $ 313,400 COP is charged to the account. From this value, the entity (Nequi) will charge a recharge commission from PayPal, which in this case was $ 13,162 COP and in addition to the VAT on commission, which was $ 2,500 COP. At the end of the day, for 100 USD, on November 10, 2018, $ 297,736 Colombian pesos were obtained in Nequi's digital savings account. Then I sent the money to myself to my Bancolombia savings account at no cost!

Personal conclusion, taking into account that the process was done with a bank that supports each and every one of the transactions, there were no unknown intermediaries on the internet, the exchange rate is fair, this process is undoubtedly the best that exists. Once you change the money, your balance is in Colombian pesos in Nequi. From nequi you can send the money back to another person, withdraw it, send it to a bank account or whatever you need.

4. Send Colombian money to a bank account or other nequi account

Note

Nequi is in itself a Colombian savings account, only it has a maximum balance limit of $ 6,249,936 Colombian pesos and each month you can use up to $ 2,148,416 (these limits are met by legal norm). However, you can break the ceiling by paying about $ 15,000 pesos once in your life and it will be an unlimited savings account p. ex. Now you can save for a car, have a saving the size of a guaca in your mattress or send someone the money you want.

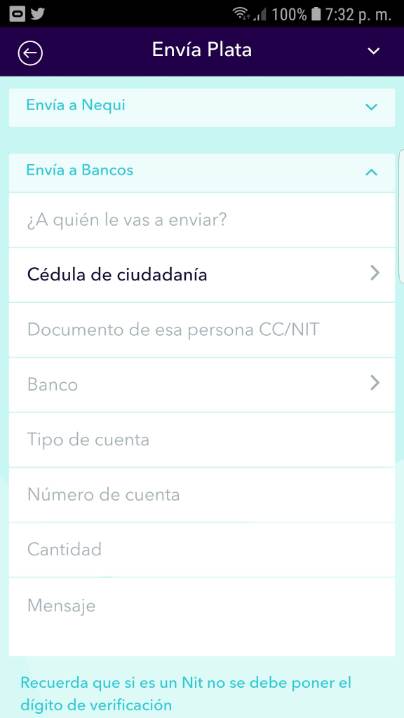

For many, the bank account is the easiest way to manage money, so it is probably the place where you want to keep your money received from PayPal. The form to send money from any of your Nequi pockets is quite simple, access the area to send money, select send to Banks and you will get the following form:

In our case, we send it to a savings account of the Bancolombia bank. In the bank list you will find almost all the banks available in Colombia p. ex. Davivienda, Banco de Bogotá, Banco Caja Social etc. Just select it, change the type of account, enter the number, the amount of money in Colombian pesos that you want to consign and that's it!

After a lot of bustle all these years looking for a way to withdraw the money from your PayPal account to your bank account in Colombia or in cash, Nequi makes things easier with this new alliance, in which you do not need to start your own company or things like that .