Cloud spending isn’t just growing—it’s splintering across providers. According to Flexera’s 2024 State of the Cloud Report, 89 percent of companies now run workloads in more than one cloud, and 32 percent spend over $12 million per year to do it. Tracking every line item is tougher than shipping the code that creates it. Investors feel that pain too: on January 29, 2025, Finout closed a $40 million Series C to modernize multi-cloud billing automation. This guide tests nine purpose-built platforms and groups them by the job you need done—so you can tame billing chaos before the next invoice arrives.

How we evaluated the field

We cast a wide net. G2’s Cloud Cost Management grid listed 205 products in its Winter 2026 release. Applying two must-haves — native ingestion for AWS, Azure, and Google Cloud and a public update or funding round after January 1, 2024 — trimmed that roster to 27.

Next, we tested each candidate against five questions:

- Does it merge raw usage data into one queryable ledger?

- Can it automate savings rather than only alerting?

- How precisely can it allocate spend by team, product, or customer?

- Will it fit existing workflows such as Terraform, Slack, or ServiceNow without weeks of tuning?

- Is the vendor still shipping meaningful features and patches?

Bill consolidation and automation accounted for 40 percent of the score. Analytics depth, integration polish, and security posture covered the rest. We also verified claims against an independent teardown by Hokstad Consulting.

Nine platforms met the bar. Each one excels at a specific job to be done: reseller billing, hands-free optimization, cost-intelligence dashboards, or enterprise chargeback. Here’s how they stack up.

TD SYNNEX CloudSolv: for cloud resellers and MSPs

Resellers don’t just buy cloud, they resell it across dozens of tenants, currencies, and price books. The complexity is growing fast: Canalys projects that more than 50 percent of hyperscaler marketplace sales will run through channel partners by 2027. TD SYNNEX built CloudSolv to keep those transactions billable and profitable.

CloudSolv sits on the StreamOne platform you may already use for provisioning. The difference is billing consolidation. Spin up AWS, Azure, Google Cloud, or Microsoft 365 for any customer and CloudSolv folds usage, discounts, and partner rebates into one invoice you can white-label in minutes. Those same storefronts let partners include business communication solutions such as UCaaS and CCaaS subscriptions in the exact same cart, so a single quote covers every workload from voicemail to virtual machines. Real-time margin dashboards flag deals that erode profit before month-end.

TD SYNNEX’s CloudSolv portal centralizes multi-cloud offers and billing workflows for channel partners

Automation sweeps for vendor credits and multi-cloud bundle pricing, then applies them automatically. Partners who opt in can surface cost-saving recommendations such as reserved-instance combos or multi-year SaaS terms directly on the quote rather than after the bill.

Because CloudSolv is part of TD SYNNEX’s broader ecosystem, you also inherit 24/7 channel support, training tracks, and StreamOne APIs for PSA or ERP hand-off. On October 6, 2025, the distributor launched a Global FinOps Practice, the TD SYNNEX Global FinOps Practice powered by IBM Cloudability, to extend those analytics further downstream. The practice gives resellers, MSPs, and systems integrators access to regional FinOps centers of excellence, advanced analytics dashboards, and hands-on guidance for right-sizing, savings planning, and forecasting so they can launch or scale a FinOps discipline without starting from scratch. According to its FinOps overview from TD SYNNEX, this IBM Cloudability based solution has helped organizations cut cloud unit costs by more than 30 percent, which turns CloudSolv from a billing hub into the front door for a broader profitability program.

If your business model hinges on accurate, on-time customer invoices instead of deep internal optimization, CloudSolv turns multi-provider chaos into a single line on the balance sheet.

nOps – your always-on cost watchdog

nOps treats cost drift the same way a pager treats downtime: it acts, not just alerts. The SaaS platform ingests AWS, Azure, and Google Cloud telemetry every few minutes, then enforces guardrails you set:

- Shut idle workloads after hours.

- Right-size over-provisioned databases before the next sprint.

- Buy Savings Plans the moment usage justifies the commitment.

The automation matters because engineers rarely find time to chase waste. nOps now oversees more than $2 billion in annual cloud spend and reports average savings of 50 percent for many customers. For iSpot.tv, its ShareSave engine pushed Reserved-Instance coverage to 95 percent of EC2 hours.

Spot by NetApp automates spot instance orchestration to cut compute and Kubernetes infrastructure costs

Controls stay in your hands. Require approval for production accounts or let nOps auto-clean only development sandboxes. Cost estimates surface in every pull request, and anomaly alerts land in Slack with a direct link to the offending resource, cutting the scavenger hunt.

For lean DevOps teams that want real savings without a full-time FinOps analyst, nOps is the closest thing to a self-cleaning cloud.

Spot by NetApp: let automation pay your compute bill

Unified dashboards and automation help FinOps teams tame fragmented multi-cloud billing at scale

Compute spend is often the biggest line on a cloud invoice. Spot by NetApp (added to Flexera’s FinOps portfolio on March 4, 2025) trims that cost with hands-free automation.

Spot’s engine predicts spare-capacity windows on AWS, Azure, and GCP up to 15 minutes in advance, shifts workloads from on-demand to spot instances, and rolls back if capacity dries up. NetApp’s own IT team cut infrastructure costs 50 to 75 percent across HR and intranet apps during a 60-day pilot.

nOps automates idle shutdowns, rightsizing, and Savings Plans so lean DevOps teams get a self-cleaning cloud

For containerized stacks, Spot Ocean right-sizes pods and blends instance types so clusters stay available while running on the cheapest fleet. Porter, a logistics platform, now runs 100 percent of production on spot instances after an Ocean proof-of-concept.

CloudCheckr, bundled with the suite, adds granular cost and compliance reports, giving finance confidence in the savings while security tracks every change. Together, these tools turn volatile pricing into predictable margin without manual babysitting.

If compute-heavy workloads or Kubernetes clusters dominate your bill, Spot’s automation can reclaim dollars you have already budgeted for.

Finout: your single source of spend truth

Finout stitches every bill — AWS, Azure, GCP, Snowflake, Datadog — into a real-time “MegaBill.” The unified ledger refreshes every few minutes, so finance sees consolidated totals while engineers drill down to a single pod or customer without waiting on a spreadsheet export.

Finout’s MegaBill unifies AWS, Azure, GCP, and SaaS costs into a single ledger for real-time FinOps insights

Two features set it apart. Virtual tagging lets you map any resource to a product, team, or tenant in seconds, even if live tags are messy. Unit-economics dashboards then surface cost per customer or per API call, turning gross spend into margins everyone can act on.

The approach is resonating. Finout has raised $85 million to date, including a $40 million Series C on January 29, 2025, and holds a 4.5-star rating across 68 reviews on G2. Power users push its enriched data straight to Snowflake or BigQuery to connect cost with revenue KPIs.

If your team craves instant clarity, plus proof that yesterday’s GPU experiment didn’t torch today’s margins, Finout’s MegaBill delivers that insight without agent installs or tag rewrites.

CloudZero: turn spend into storytelling

CloudZero’s AnyCost engine pulls AWS, Azure, GCP, Kubernetes, and SaaS bills into one dataset, then auto-groups resources into Cost Categories that mirror your product map. A product manager can open one page and see cost per daily active user five minutes after a deploy instead of waiting for month-end close.

CloudZero’s cost intelligence platform turns multi-cloud and AI spend into unit economics your board can understand

Two numbers show momentum. CloudZero closed a $56 million Series C on May 22, 2025 to expand AI-driven analytics and integration breadth, and it holds a 4.7-star rating on G2 across 140 reviews. Customers such as DraftKings rely on its Slack alerts and natural-language assistant to spot spending anomalies in under ten minutes.

Since perfect tagging is rare, CloudZero applies heuristics to fill gaps, so finance discusses strategy while engineers stay focused on code, not spreadsheets. If your board measures margin per feature release, CloudZero turns that KPI into a live dashboard without extra BI plumbing.

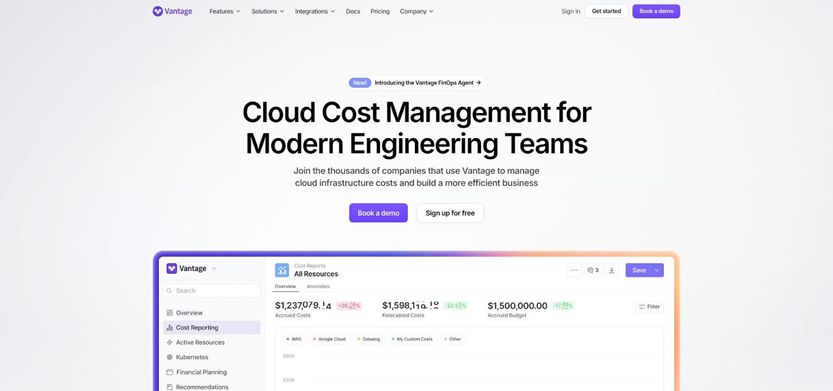

Vantage: clarity in under an hour

Most cost tools demand a week of setup; Vantage usually needs about 15 minutes. Connect read-only credentials and its modern UI shows AWS, Azure, and GCP spend in a format that feels closer to a banking app than a cloud console.

Vantage delivers a banking-app-style view of AWS, Azure, and GCP spend in about fifteen minutes of setup

The free Starter tier tracks up to $2,500 in monthly cloud spend. After that you can drag and drop resources into virtual tags — backend, marketing demo, customer-alpha — without touching live metadata. Vantage remembers the mapping for every future invoice.

Recommendations focus on quick wins: delete unattached EBS volumes, downsize a t3.large, or enable AWS Savings Plans. Autopilot, released in 2024, can even purchase those plans for a five percent share of realized savings.

Vantage raised $21 million in Series A funding on March 8, 2023 and now processes more than $1 billion in annual cloud costs for over 300 customers. For startups and small dev teams, that adds up to enterprise-grade FinOps clarity before your next sprint demo.

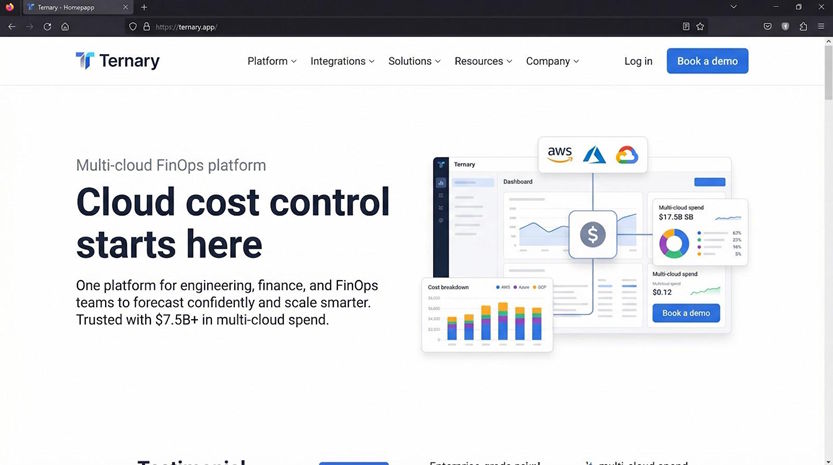

Ternary: granular control at billion-dollar scale

Ternary was built for organizations whose cloud bill rivals a Fortune 500 P&L. The platform ingests AWS Cost and Usage Reports, Azure EA or MCA exports, and GCP BigQuery data, then converts them into a single currency-normalized ledger that finance trusts and engineers can drill to the namespace.

Ternary provides a multi-cloud FinOps control plane for finance, engineering, and MSP teams managing billion-dollar bills

Two facts show why it resonates. Ternary raised $12 million in Series A funding on October 23, 2023, and several customers now manage more than $6 billion in annual cloud spend through its dashboards. A recent G2 report rates it 4.9 out of 5 across 45 reviews, the highest in the FinOps category.

Why large enterprises choose it:

- Self-host or SaaS. Banks and governments keep billing data inside their own VPC yet still receive weekly feature updates.

- Policy engine. Break a tagging or budget rule and Ternary can ping Slack, open a Jira ticket, or block the next Terraform apply.

- MSP mode. Service providers view all clients from one pane, while each tenant sees only their branded reports and fiscal calendar.

If compliance, data locality, or iron-clad chargeback keep you up at night, Ternary offers a FinOps control plane that scales with your ledger.

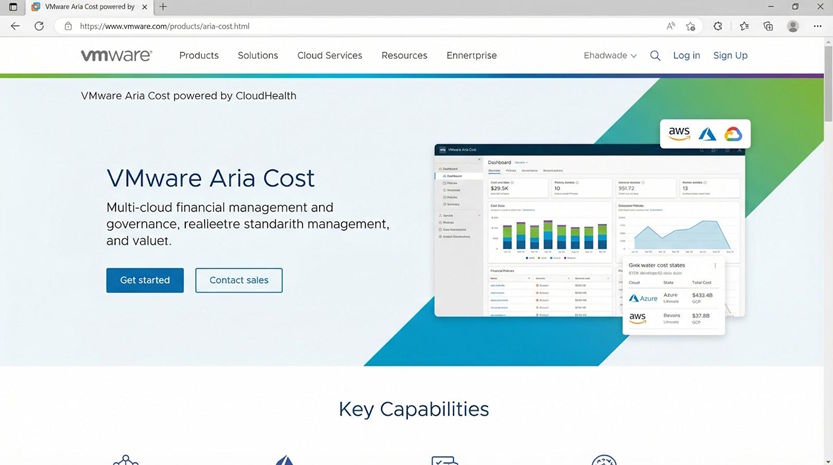

VMware Aria Cost (CloudHealth): governance muscle for complex clouds

CloudHealth, now branded VMware Aria Cost after Broadcom completed its $61 billion VMware acquisition on November 22, 2023, remains a veteran of FinOps. More than 22,000 organizations rely on the platform to optimize and govern $24 billion in annual multi-cloud spend.

VMware Aria Cost, formerly CloudHealth, brings policy-driven governance to complex multi-cloud and hybrid estates

Why enterprises choose it:

- Policy engine. Create rules for budgets, tagging, or security; Aria Cost can email an owner, open a ServiceNow ticket, or run a script when a line is crossed.

- Hybrid reach. Ingests AWS, Azure, GCP, on-prem vCenter, and VMware Cloud Foundation, which helps when your estate spans hundreds of accounts and data centers.

- AI assistant. The 2025 Intelligent Assist update answers questions such as Why did EU-West costs jump last week? and surfaces the exact service driving the variance.

Global firms also lean on its multi-currency reports, translating spend overnight so AP teams in Tokyo and Toronto read numbers in local terms. The trade-off is depth can add complexity; most customers plan a guided rollout rather than same-day self-service. If auditors and regulators comb through your books, Aria Cost’s decade of governance guardrails can spare weeks of spreadsheet work.

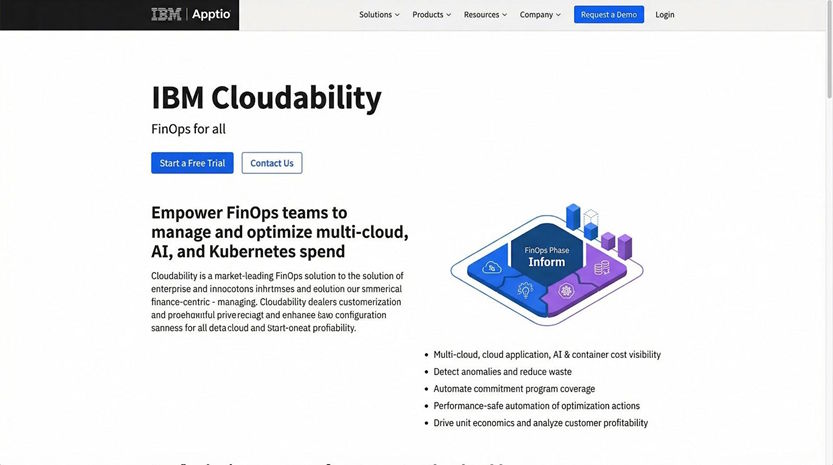

Apptio Cloudability: financial rigor meets cloud agility

IBM completed its $4.6 billion acquisition of Apptio on August 10, 2023, folding Cloudability into a FinOps stack that also includes Turbonomic for performance automation and the Kubecost OpenCost engine for Kubernetes. Today, more than 1,500 enterprises, including 60 percent of the Fortune 100, rely on Apptio products to manage technology spend.

Cloudability pulls AWS, Azure, GCP, and Oracle Cloud Infrastructure data into the same ledger, then layers on on-prem costs from ApptioOne so finance sees a full IT P&L. Its rules-based allocator leaves no dollar untracked: shared networks can split by algorithmic weight, platform teams absorb prorated support fees, and business units view only what they consume.

IBM Cloudability combines multi-cloud, AI, and Kubernetes spend into a FinOps platform built for full IT P&L control

What’s new:

- Cloudwiry automation. Acquired in 2023, Cloudwiry logic now auto-purchases Reservations and Savings Plans when coverage drops, saving customers an average 22 percent on EC2 commitments.

- Watsonx synergy. IBM is training cost-forecast models on Cloudability’s $450 billion anonymized IT-spend dataset, aiming for faster anomaly detection in 2026.

Cloudability still requires a consultative rollout, but once connected, CFOs can ask, What will our AI expansion add to COGS next quarter? and view the answer as a chart, not a spreadsheet guess.

Comparison matrix at a glance

|

Tool |

Clouds covered |

Hands-off actions |

Allocation granularity* |

Self-host option |

Free tier |

Best fit |

|

CloudSolv |

AWS • Azure • GCP + SaaS catalog |

Consolidates invoices, applies distributor credits |

Per customer |

No |

Partner portal |

Resellers and MSPs |

|

nOps |

AWS • Azure • GCP |

Stop idle, right-size, auto Savings Plans |

Project and Kubernetes namespace |

No |

14-day trial |

Lean DevOps squads |

|

Spot by NetApp |

AWS • Azure • GCP • Kubernetes |

Spot-instance orchestration, RI automation |

Service and tag (via CloudCheckr) |

No |

30-day pilot |

Compute-heavy workloads |

|

Finout |

AWS • Azure • GCP • SaaS |

Alerts plus RI suggestions |

Customer, feature, pod |

No |

Startup tier up to $100,000 per month |

SaaS scale-ups |

|

CloudZero |

AWS • Azure • GCP • SaaS |

Anomaly alerts |

Cost Category (unit economics) |

No |

Freemium |

Product-led teams |

|

Vantage |

AWS • Azure • GCP • SaaS |

Rightsize and idle alerts |

Tag plus virtual tag |

No |

$2,500 spend per month |

Startups and SMBs |

|

Ternary |

AWS • Azure • GCP • Kubernetes |

Policy breach alerts, block infrastructure as code |

Business unit, project, namespace |

Yes |

None |

Regulated enterprises |

|

Aria Cost |

AWS • Azure • GCP • vCenter |

Scripted fixes, budgets |

Tag, account, business unit |

Appliance mode |

None |

Global enterprises |

|

Cloudability |

AWS • Azure • GCP • OCI + on-prem |

Forecasts, RI planner |

Full ITFM model |

No |

None |

Finance-driven organizations |

*Allocation granularity refers to the most specific slice available out of the box.

Key take-aways

- Need hands-off remediation? Spot and nOps execute changes, while others advise.

- Chasing unit economics? Finout and CloudZero surface per-customer or per-feature costs.

- Concerned about data residency? Ternary (self-host) or Aria Cost (on-prem appliance) keep ledgers inside your cloud.

- Working with a tight budget? Vantage’s free tier offers a no-risk starting point.

Conclusion

Picking a FinOps platform should not start with a features spreadsheet; it should start with one question: what keeps us up at night? The FinOps Foundation’s 2024 survey shows that reducing waste is the top priority for 54 percent of teams, followed by managing commitment-based discounts at 42 percent. Anchor your search to the pain you feel most.

- Match the pain to the product.

- Map your environment truthfully. Count clouds, regions, and major SaaS items. A single-cloud startup with heavy Snowflake spend gains more from Finout’s SaaS ingestion than from heavyweight governance suites.

- Respect culture and workflows. Developer-led teams thrive on Slack alerts and pull-request cost checks, while finance-driven shops prefer scheduled forecasts and GL exports.

- Check data policy early. If regulators forbid sending CUR files off-prem, consider self-hosted options like Ternary or the on-prem appliance for Aria Cost.

- Model tool cost against upside. Whether the vendor charges a flat fee or a share of savings, run a quick calculation: does this software pay for itself inside a quarter? If not, keep looking.

Run two short pilots in parallel. Feed each platform the same billing month, measure the dollars or hours it saves, and select the one that lifts the KPI you named in step 1.