In the fast-paced world of investing, leveraging advanced technology can significantly enhance your stock market strategies. As the landscape continues to evolve, having the right tools at your disposal is essential for success—whether you're a seasoned trader looking to refine your approach, a business owner aiming to make data-driven decisions, or a newcomer eager to navigate the complexities of the market.

This article presents the top 8 AI stock analysis tools for 2025, meticulously curated to empower you with the insights needed for informed investment choices. We've assessed each option based on key factors such as features, pricing, user experience, and overall value. Dive in to discover the ideal solutions that cater to your unique needs and help you stay ahead in the dynamic world of stock trading.

Website List

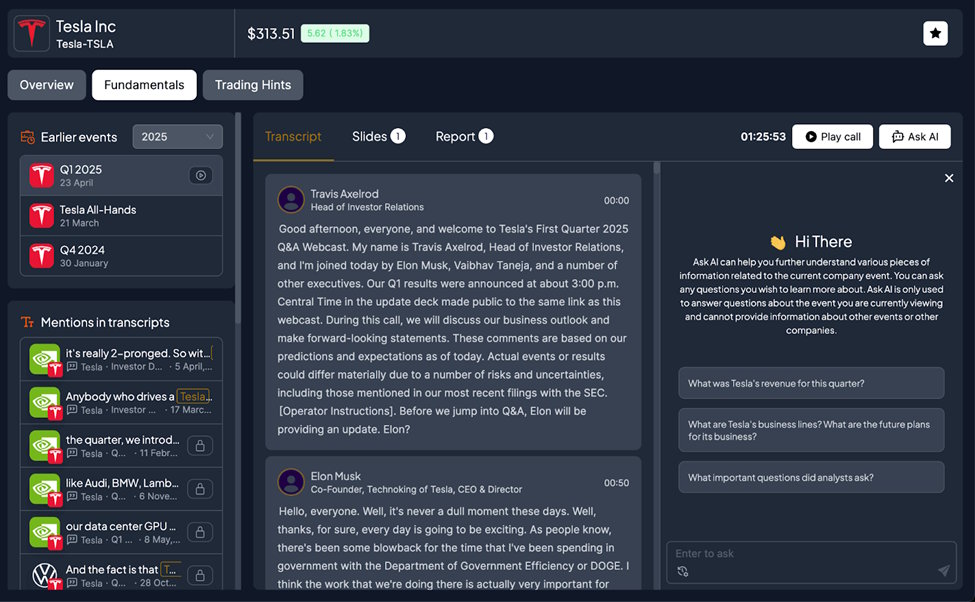

1. BestStock AI

What is BestStock AI

BestStock AI is an AI-powered platform designed to provide in-depth stock analysis and financial data for both professionals and long-term investors. Its main purpose is to automate financial data processing and deliver actionable insights, enabling users to make smarter investment decisions without the need for manual work. By offering comprehensive market intelligence, including corporate financials and curated research, BestStock AI empowers users to navigate the complexities of the stock market efficiently. If you're looking to measure your investment growth over time, consider using a CAGR calculator to easily determine the compound annual growth rate of your investments.

Features

- AI-driven financial analysis for automated insights and data processing, eliminating manual work

- Comprehensive access to US stock financials, earnings transcripts, and curated research for informed investment decisions

- Advanced statistical and business analysis tools for in-depth market intelligence and trend tracking

- User-friendly data visualization features that enhance understanding of complex financial metrics

- Seamless integration with existing workflows for a streamlined research experience and improved efficiency

Pros and Cons

Pros:

- AI-powered financial analysis automates data processing for actionable insights

- Access to comprehensive US stock financials and earnings transcripts

- Curated research and daily AI-driven insights enhance investment decision-making

- Intuitive design that supports seamless research flow for users

Cons:

- Higher cost compared to some competing market data platforms

- Limited offline capabilities may restrict access in low-connectivity areas

- Mobile app functionality may need further enhancements for user convenience

Price

Free

- Price: $0/data.87

- Features: Essential features, always free, 3 Copilot Prompts/mo, 2 investor Relations

Plus

- Price: $24.9/data.87

- Features: Smarter insights, more interactions, 100 shared AI credits per month, 1Y event history (Calls, Transcripts & Slides), 5 Custom Watchlist, 3 Quarters of Estimates

Premium

- Price: $49.9/data.87

- Features: Deeper coverage, broader tools, 500 shared AI credits per month, 3Y event history (Calls, Transcripts & Slides), 15 Custom Watchlist, Unlimited Estimates

Ultimate

- Price: $166.6/data.87

- Features: Unlimited Copilot, focused research, 1000 shared AI credits per month, Copilot: no credits required, Company AI: 20 credits per report, All event history (Calls, Transcripts & Slides), Unlimited Dashboards & Rows, Unlimited watchlists, Unlimited Estimates

Best for who

- Financial Analysts: Ideal for professionals seeking comprehensive market data and AI-driven insights to enhance their investment strategies and decision-making processes.

- Investment Firms: Perfect for firms looking to automate financial analysis and streamline research workflows, enabling their teams to focus on high-level strategic planning rather than manual data processing.

- Long-Term Investors: Excellent choice for individual investors who want access to trusted market intelligence and detailed financial analytics to make informed investment decisions over time.

2. StocksToTrade

What is StocksToTrade

StocksToTrade is an all-in-one trading platform designed to empower both novice and experienced traders with essential tools and resources for successful stock trading. It offers a comprehensive suite of features, including real-time market data, trading guides, and educational content on various trading strategies, making it an invaluable resource for those looking to enhance their trading skills and make informed investment decisions. By combining powerful stock scanners, detailed market analysis, and a supportive community, StocksToTrade aims to streamline the trading process and boost traders' confidence in their strategies.

Features

- Comprehensive educational resources, including beginner guides and trading strategies to empower informed investment decisions

- Advanced trading tools, such as Level 2 quotes and chart pattern screeners, for enhanced market analysis

- Flexible trading options, including margin trading and short selling, to optimize your investment approach

- User-friendly platform with customizable watchlists and trading setups for personalized experiences

- Regular content updates and expert insights to keep you informed on the latest market trends and strategies

Pros and Cons

Pros:

- Comprehensive guides covering a wide range of trading topics

- User-friendly resources for both beginners and experienced traders

- Access to advanced trading tools and features like Level 2 quotes

- Regularly updated content to reflect current market trends

Cons:

- May require a subscription for full access to premium content

- Information overload for beginners not familiar with trading terminology

- Limited focus on mobile trading capabilities and app features

Price

Trial Options (14-Day Trial)

The Brokers With 14-Day Trials of StocksToTrade

There are a few trial options available with limited functionality, designed to help users get a basic understanding of how the platform works:

- Basic Trial: $7 for 14 days

Includes base platform access with limited features and little to no real-time data.

- Trial + Breaking News Chat: $17 for 14 days

Includes base access plus live access to the breaking news chat feature.

- Trial + Small-Cap Rockets: $18 for 14 days

Includes access to the Small-Cap Rockets scanner, a hot stocks scanner focused on momentum stocks.

Trials are single-purpose evaluation options intended solely for testing the platform.

Core Subscription Plans

- Monthly Plan: $179.95 per month

Unlimited access to the full StocksToTrade platform.

- Quarterly Plan: $539.85 per quarter

Three months of platform access, billed in advance.

- Annual Plan: $1,899.50 per year

Offers savings compared to monthly billing and provides the best long-term value.

Optional Add-Ons

Users can enhance the core platform with the following premium add-ons:

- Small-Cap Rockets

$50 per month or $500 per year

- Breaking News Chat

$49 per month or $490 per year

- TipRanks Integration

$8.95 per month or $89.50 per year

- Level 2 Market Data

$29 per month or $345 per year

These add-ons provide additional market data, news coverage, and analytical depth beyond the base platform.

Best for who

- Beginner Traders: Ideal for individuals new to trading who need comprehensive guides and resources to understand the basics of stock trading and develop their skills.

- Active Day Traders: Best suited for seasoned traders looking for advanced tools, real-time data, and strategies to enhance their trading performance and decision-making process.

- Investors Seeking Knowledge: Perfect for those aiming to deepen their understanding of trading psychology and technical analysis, providing them with essential insights to make informed investment choices.

3. RockFlow

What is RockFlow

RockFlow is an innovative AI-driven fintech platform designed to simplify and enhance the investing experience. With its AI assistant, Bobby, users can quickly build portfolios, execute trades, and discover market trends, all while leveraging advanced data analysis and institutional-grade models. The main value proposition lies in its ability to make trading accessible and enjoyable, allowing users to trade smarter and more efficiently.

Features

- AI-driven portfolio management that streamlines trading and investment strategies

- Real-time market insights by analyzing 1000+ data streams for informed decision-making

- 24/7 trading assistance that ensures you never miss an opportunity

- Social media trend analysis for proactive investment strategies and risk management

- Seamless trader matching to connect you with top performers for collaborative investing

Pros and Cons

Pros:

- Effortless portfolio building and trading capabilities powered by AI

- Access to a wealth of data and advanced quant models for informed decision-making

- Real-time analysis of social media trends and risks to enhance trading strategies

- 24/7 assistance with trade execution, making it ideal for busy investors

Cons:

- Potential learning curve for users unfamiliar with AI-driven trading

- Reliance on technology may raise concerns for users preferring traditional trading methods

- Limited offline functionality could hinder access in low-connectivity environments

Price

- Free Plan: Basic access with limited transactions (up to 1 fractional share per month)

- Fractional Share Plan: $0.0035/share - Commission for fractional shares with a minimum charge of $0.20 per order

- Whole Share Plan: $0.0035/share - Commission for whole shares with a minimum charge of $0.50 per order, maximum charge of 1% of trade value

- Platform Fee: $0.0038/share - Additional fee for fractional shares with a minimum charge of $0.20 per order

Best for who

- Individual Investors: Perfect for personal investors looking to simplify their trading experience while leveraging AI to make smarter investment decisions effortlessly.

- Active Traders: Ideal for those who need real-time insights and trend analysis, allowing them to capitalize on market movements and manage their portfolios efficiently.

- Financial Advisors: Excellent choice for advisors seeking to enhance their services by utilizing AI-driven insights to optimize client portfolios and identify emerging trading opportunities.

4. AlphaInsider

What is AlphaInsider

AlphaInsider is an open marketplace designed for trading strategies, connecting traders and investors with a diverse range of algorithmic and manual trading systems. Its main purpose is to empower users by providing access to innovative strategies and insights, helping them enhance their trading performance and make informed decisions. By fostering a collaborative environment, AlphaInsider adds significant value for both strategy creators and traders seeking to diversify their portfolios.

Features

- Intuitive user interface that simplifies navigation and enhances user experience

- Robust analytics and reporting tools for data-driven decision making

- Scalable solutions designed to grow with your business needs

- Real-time collaboration capabilities to boost team productivity

- Comprehensive training resources and onboarding support for seamless implementation

Pros and Cons

Pros:

- High scalability to accommodate growing business needs

- User-friendly interface that simplifies navigation and usability

- Strong security features ensuring data protection and compliance

- Regular updates with new features and enhancements

Cons:

- Higher initial setup cost compared to some competitors

- Limited integrations with third-party applications

- Occasional bugs that require timely patches and fixes

Price

- Free Tier: Best for real-time trade alerts, includes 1 Broker Connection, 1 Strategy Per Broker, Increased Trading Bot Leverage, See Open Orders, Private Strategies, 10 Subscriptions, 5 User Strategies, 50 Orders Per Strategy A Day, and Instant Push Notifications.

- Pro Plan: $50/month - Best for multi-strategy diversification, includes 1 Broker Connection, 100 Strategies Per Broker, Increased Trading Bot Leverage, See Open Orders, Private Strategies, 100 Subscriptions, 50 User Strategies, 500 Orders Per Strategy A Day, and Instant Push Notifications.

- Premium Plan: $100/month - Best for comprehensive trading strategy management, additional features include enhanced support and unlimited strategies, details available upon request.

Best for who

- Traders who are involved in trading communities and looking to analyze, collaborate and discover the performance of real trading strategies from other active market participators.

- Traders who want to follow a model or research-based strategy, with more of an emphasis on reviewing historical performance than developing analysis from the ground-up.

- Retail investors who are proactive and using tools to get more real-time capabilities as well as screening strategies and performance tracking which can help ensure faster, better decisions.

5. Stockinsights

What is Stockinsights

Stockinsights.ai is an innovative platform designed to enhance equity research through the power of generative AI, focusing on public company filings and earnings transcripts. Its main purpose is to streamline the research process for value investors by providing advanced tools that simplify data analysis, enabling users to spend less time on data collection and more on making informed investment decisions. With coverage of US and India markets, Stockinsights empowers investment professionals with actionable insights and increased productivity in their workflows.

Features

- AI-driven analysis of public company filings and earnings transcripts to enhance your financial research

- Streamlined due diligence process powered by cutting-edge technology for efficient decision-making

- Comprehensive insights from multiple datasets to empower informed investment choices

- Effortless tracking of portfolio companies to keep you updated on your investments

- User-friendly platform designed for both value investors and investment professionals

Pros and Cons

Pros:

- AI-powered features enhance research capabilities for value investors

- Comprehensive insights from multiple datasets streamline due diligence

- Efficient tracking of portfolio companies keeps investors informed effortlessly

- Designed to save time on data collection, allowing for more focus on decision-making

Cons:

- Currently limited to US and India markets, which may not suit all investors

- May require adjustment period for those unfamiliar with generative AI tools

- Potentially high reliance on AI could lead to oversight of nuanced information

Price

- Free

- Price: $0/year

- Features:

- 10 AI-Summaries/month for Earnings Calls

- 10 monthly AI searches: Earnings Calls & 10-Ks

- 8K-Dashboard: Last one day's 8-Ks

- Watchlists & Alerts: Up to 5 stocks

- Pro

- Price: $200/year

- Features:

- Unlimited AI-Summaries for Earnings Calls

- Unlimited AI-Search over Earnings Calls and 10-Ks

- 8K-Dashboard: Full Access

- Watchlists & Alerts: Up to 700 stocks

- Advanced

- Price: Custom

- Features:

- Custom Screeners

- Custom Data Integrations

- Team Accounts

- Dedicated Support and Consulting

Discounted subscriptions are available for on-campus student organizations and classes.

Best for who

- Value Investors: Ideal for investors seeking to enhance their research capabilities and streamline due diligence processes with AI-powered insights drawn from public company filings and earnings transcripts.

- Investment Professionals: Perfect for analysts and portfolio managers at top firms who need to monitor disclosures and track portfolio companies effortlessly, allowing them to focus more on strategic decision-making.

- Financial Research Teams: Excellent for teams conducting comprehensive analyses across diverse datasets, enabling them to generate investment ideas and unlock insights with cutting-edge generative AI technology.

6. Stockgeist

What is Stockgeist

Stockgeist is an advanced market sentiment tracking platform that analyzes real-time social media data to gauge the popularity of 2,200 publicly traded companies. By leveraging AI deep learning technology, it empowers traders to quickly interpret vast amounts of information, offering insights that can enhance investment decisions. With features like a financial chatbot, Stockgeist provides valuable, actionable data to help users navigate the stock and cryptocurrency markets effectively.

Features

- Sentiment screener for analyzing historical sentiment patterns and comparing companies across various metrics

- Expanded company coverage to include diverse industries beyond technology and biotechnology

- Intuitive portfolio management tools to track stock performance, sentiment, and social media activity

- Smart message content analyzer to discover insights on topics that matter most to you

- Continuous improvements driven by user feedback to enhance overall experience and functionality

Pros and Cons

Pros:

- Innovative AI-driven analysis of social media sentiment for 2200 publicly traded companies

- Real-time insights for stocks and cryptocurrencies through a financial QA chatbot

- User-friendly interface that simplifies complex data interpretation

- Enhances hedge fund performance by providing accurate market sentiment data

Cons:

- May require a steep learning curve for users unfamiliar with AI tools

- Dependence on social media data could lead to inaccuracies in sentiment analysis

- Limited offline functionality may hinder accessibility during connectivity issues

Price

Basic: €29.99 per month

Included features: 60k stocks, 40 global markets, commodities, currency pairs, current market mood in social media, social media alerts.

Premium: €199.00 per month

Included features: Full coverage of stocks, global markets, indices, lists, commodities, currency pairs, authors, historical data, watchlist AI alerts.

Platinum: €499.00 per month

Included features: Full coverage of stocks, global markets, indices, lists, commodities, currency pairs, authors, historical data, download options, real-time access, AI stock alerts.

Professional: €1,199.00 per month

Included features: Full coverage of stocks, global markets, indices, lists, commodities, currency pairs, authors, extensive history, download options, many smart filters, AI and Buzz alerts.

Best for who

- Traders: Ideal for individual traders seeking to leverage real-time social media insights to make informed decisions and stay ahead of market trends.

- Hedge Funds: Perfect for hedge fund managers looking to enhance portfolio performance through accurate market sentiment analysis, enabling better predictions of stock movements.

- Financial Analysts: Excellent choice for analysts who require comprehensive tools to interpret vast amounts of data quickly, allowing them to deliver actionable insights on stocks and cryptocurrencies.

7. Stockpulse

What is Stockpulse

Stockpulse is an advanced platform that leverages artificial intelligence to analyze financial news and social media, providing real-time social sentiment insights for smarter financial decisions. Its primary purpose is to assist financial institutions in making informed choices by monitoring market trends, detecting anomalies, and generating concise reports that enhance market analysis and risk assessment. By integrating AI-driven insights, Stockpulse helps clients like Deutsche Börse AG and Moody's improve regulatory compliance, market integrity, and overall decision-making processes.

Features

- Real-time social media monitoring to extract actionable insights for smarter financial decisions

- Advanced AI algorithms that detect market manipulation, fraud, and anomalies for enhanced regulatory compliance

- Daily output of thousands of concise AI-generated reports to support comprehensive market analysis and risk assessment

- Seamless integration of sentiment analysis tools into existing trading platforms for improved decision-making

- Tailored solutions designed for financial institutions, ensuring adaptability to specific trading needs and strategies

Pros and Cons

Pros:

- Provides real-time social sentiment analysis for informed financial decisions

- Enhances regulatory compliance and market integrity through advanced AI monitoring

- Offers concise, actionable reports that improve market analysis and risk assessment

- Integrates seamlessly with existing financial workflows for efficient use

Cons:

- May require a significant investment for full deployment

- The platform's effectiveness is dependent on the quality and volume of social media data

- Limited focus on offline capabilities for those needing access without internet connectivity

Price

- Basic: €29.99 per month

- Included assets: 60k stocks, 40 global markets, commodities, currency pairs

- Current market mood in social media

- Social Media Alerts

- Premium: €199.00 per month

- Full coverage: stocks, global markets, indices, lists, commodities, currency pairs, authors, etc.

- Historical data

- Watchlist AI Alerts

- Platinum: €499.00 per month

- Full coverage: stocks, global markets, indices, lists, commodities, currency pairs, authors, etc.

- Historical data + download options

- Real time

- AI stock alerts

- Professional: €1,199.00 per month

- Full coverage: stocks, global markets, indices, lists, commodities, currency pairs, authors, etc.

- Extensive history + download options

- Many smart filters

- AI and Buzz Alerts

Best for who

- Financial Institutions: Ideal for banks and investment firms seeking to enhance their market analysis and risk assessment through real-time social sentiment monitoring and actionable insights.

- Regulatory Compliance Teams: Best suited for organizations needing to detect market manipulation and fraud in real-time, ensuring adherence to compliance standards and maintaining market integrity.

- Investment Analysts: Perfect for professionals who require AI-generated summaries and concise reports to streamline decision-making processes and improve the accuracy of their market assessments.

8. levelfields

What is levelfields

LevelFields is an AI-driven stock trading platform that offers users advanced tools for trading stocks and options, with subscription plans tailored to different levels of expertise. Its main value proposition lies in providing data-driven insights and alerts, enabling traders to make informed decisions while minimizing the need for manual analysis. With options for both do-it-yourself and analyst-supported trading, LevelFields caters to a wide range of investors, from beginners to seasoned professionals.

Features

- Comprehensive DIY access with the Level 1 Plan for maximum user control and flexibility

- Expert analyst alerts and investment positioning included in the Level 2 Plan for informed decision-making

- Tailored training sessions to optimize platform usage and enhance trading strategies

- Unlimited customized alerts to stay updated on critical market trends and scenarios

- Easy subscription upgrade from Level 1 to Level 2, ensuring seamless transition and value retention

Pros and Cons

Pros:

- Level 1 offers complete DIY access to all scenarios and data, allowing for flexibility in usage

- Level 2 plan includes personalized training and analyst alerts, enhancing user experience

- Ability to convert from Level 1 to Level 2 with a credit toward the first month, providing financial incentive

- Customized alerts available, allowing users to tailor their experience to specific needs

Cons:

- Level 1 lacks human assistance beyond customer support, which may limit user guidance

- Limited historical data in Level 1 could affect decision-making for users requiring extensive analysis

- No downgrades from Level 2 to Level 1, which may deter users from committing to the higher plan

Price

Basic Access

- Pricing: $299 per year

- Discount: 75%

- Billed: $99 annually or $25 per month

Premium Access

- Pricing: $1599 per year

- Discount: 20%

- Billed: $167 annually or $133 per month

Best for who

- Independent Traders: Ideal for individual investors who prefer a self-directed approach and want to leverage customizable alerts and data to make informed decisions without the need for additional support.

- Investment Analysts: Best suited for professionals who require in-depth analysis and access to extensive data trends, benefiting from the Level 1 Plan's comprehensive scenario access while maintaining the flexibility to upgrade to Level 2 for enhanced insights.

- New Investors: Perfect for beginners looking to familiarize themselves with trading strategies and market data, as the Level 1 Plan offers a hands-on learning experience with the option to transition to Level 2 for personalized training and expert guidance.

Key Takeaways

- Research thoroughly before choosing an AI stock analysis solution - not all platforms offer the same level of accuracy and features.

- Consider your specific investment style and goals when evaluating AI tools to ensure they align with your trading strategy.

- Start with free trials when available to test the AI’s predictive capabilities and user interface before committing to a subscription.

- Read user reviews and testimonials to understand real-world performance and reliability of the AI stock analysis tools you’re considering.

- Stay updated with the latest advancements in AI algorithms and market analysis techniques to leverage cutting-edge insights for better investment decisions.

- Don't overlook the importance of customer support and community resources; having access to knowledgeable help can enhance your experience and effectiveness.

- Consider scalability and future growth when making your selection, as your investment strategy may evolve over time and require more sophisticated tools.

Conclusion

In conclusion, this comprehensive review of the top 8 AI stock analysis solutions provides valuable insights for making informed investment decisions in an increasingly competitive market. Each option boasts unique strengths and capabilities, making it essential to carefully consider your specific requirements, budget, and long-term goals when making your selection.

The AI stock analysis landscape continues to evolve rapidly, with new features and improvements being introduced regularly. We recommend starting with the solutions that best align with your immediate needs while considering their potential for growth and adaptation as your requirements change. Remember that the most expensive option isn't always the best, and the most feature-rich solution might not be the most suitable for your specific investment strategy.

Take advantage of free trials and demos to experience these tools firsthand, and don't hesitate to reach out to customer support teams with questions. The right AI stock analysis solution can significantly enhance your investment productivity and success, making the time invested in research and evaluation well worth the effort. Start exploring these options today to elevate your stock market strategies!