Everyone is yelling about DEX and CEX as if it's the end of a reality show episode. One side claims that decentralized exchanges are a labyrinth created by hackers for amusement, while the other claims that centralized exchanges are diabolical masterminds. You don't want to become involved in a cryptocurrency civil war; you just want to trade.

When you click on one app, it requests your ID, a selfie, and possibly your childhood moniker. When you try a different site, it instructs you to connect a wallet, approve five transactions, and hope your lunch money is not eaten by the gas fee. Greetings from the world of DEX and CEX.

The amusing thing is that both views are simultaneously correct and incorrect. One offers you speed and comfort, while the other offers you autonomy and accountability. You quit freaking out, stop debating in comment areas, and start trading like someone who truly understands how DEX and CEX operate. Let’s dive into the world of CEX and DEX.

Comprehending Centralized Exchanges and Their Functions

A company-managed cryptocurrency trading platform is called a centralized exchange, or CEX. Consider it comparable to opening an online bank account. The site handles the trading procedure once you create an account and add funds or cryptocurrency. This group includes well-known companies like OKX, Coinbase, and Binance.

CEX platforms tend to feel more familiar than DEX. After logging in and selecting "buy" or "sell," your trade is completed nearly immediately. It seems simple, doesn't it? Here, the exchange keeps your money and handles your private keys.

For novices, CEX platforms are excellent. You appreciate quick transactions, helpful staff, and cutting-edge choices like futures trading. The drawback? You relinquish some authority. Convenience frequently comes at the expense of trust in the CEX and DEX argument.

Identifying a DEX and How It Actually Operates

A decentralized exchange, often known as a DEX, operates independently of a central business. Rather, all trades are automatically managed by smart contracts on Flipper or another DEX. All you have to do is link your cryptocurrency wallet, verify the transaction, and trade directly from your wallet. It sounds easy, doesn't it?

In the debate between DEX and CEX, various DEX platforms attract users who desire complete control. There is no complex sign-up process or KYC, and no one can freeze your money. You even maintain your private keys. This independence is welcome in the realm of DEX and CEX crypto.

Here's the catch, though. You must be aware of wallets, gas costs, and network latency when using a DEX. Make a mistake? No support staff is available to resolve it. Freedom on a DEX also entails accepting complete accountability for every decision you make when it comes to CEX DEX options.

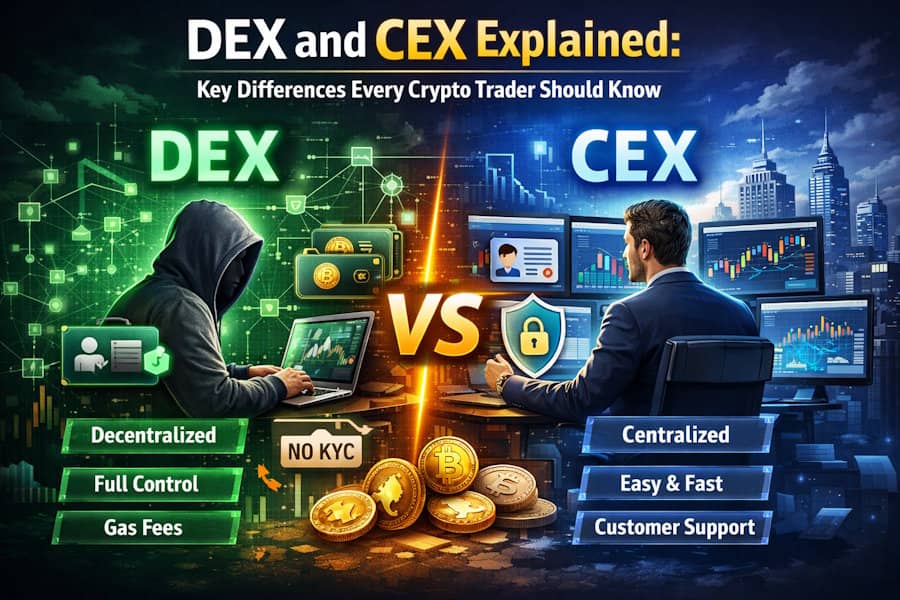

Principal Distinctions Between Centralized and Decentralized Exchanges

The distinctions between DEX and CEX are readily apparent. With a DEX, you maintain complete control of your money, whereas with a CEX, the platform holds it for you. Doesn't a DEX seem empowering? Many traders switch from CEX to DEX when their confidence grows because of this independence.

CEX and DEX operate differently in terms of safety. Even while centralized platforms invest heavily in security, hacking still occurs. Although smart contract problems may arise, a DEX reduces this risk because your funds remain in your wallet.

Another gap in CEX vs DEX is ease of usage. While DEX platforms require some technical expertise, such as managing wallets and gas fees, CEX platforms seem more accessible to novices. Privacy is important as well. Comparing DEX and CEX cryptocurrency is crucial for those who value privacy since DEX trading allows you to remain anonymous while CEX platforms require identification.

Differentiating Between DEX and CEX: Costs, Speed, and Liquidity

Fees are frequently the first thing that catches your eye when comparing DEX vs CEX. You often pay trading fees, withdrawal fees, and occasionally even deposit costs on centralized exchanges. The positive aspect? There is a lot of liquidity, and your deals process quickly. Large orders are filled fast and without stress.

Decentralized systems feel different because of the variations between DEX and CEX cryptocurrency. You still have to pay blockchain gas fees even if a coin DEX offers cheaper trading fees. Additionally, those fees might be expensive when the network is crowded. Moreover, liquidity might fluctuate, particularly with smaller coins.

What is more important to you, then? You might like CEX over DEX because of its speed and deep liquidity. Even though it requires a little more work, DEX and CEX options may encourage you to use a DEX if control and transparency are important to you.

Final Verdict

The debate between DEX CEX has no clear winner. To be honest, it all depends on your preferences and level of experience with cryptocurrency. Are you just getting started? A CEX could thus feel like training wheels. You receive easy-to-use tools, straightforward instructions, and customer service to assist you in steering clear of novice blunders.

However, a DEX might be your thing if you already know your way around and want complete control. Ownership is the main distinction between CEX/DEX cryptocurrency. With a DEX, you can own your assets without the need for an intermediary.

Many astute traders don't even take sides. They combine the use of CEX and DEX. After making a purchase on a CEX, you can transfer crypto to a DEX for trading or staking. You have a significant advantage over traders who restrict themselves to a single option if you understand how coin DEX and CEX platforms can operate together.